Updated August 17, 2023

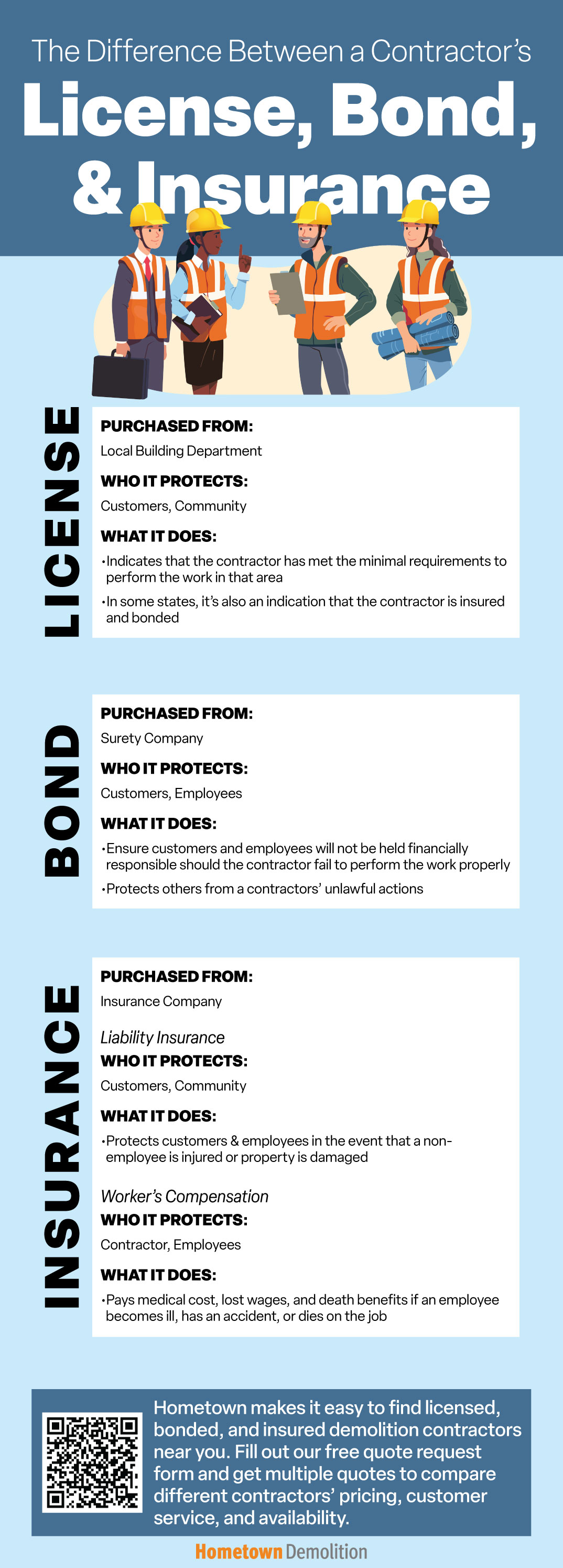

You may have heard contractors claim to be licensed, bonded, and/or insured, but what do these labels mean, and how are they different from one another?

If you plan on hiring a contractor, make sure you understand the distinction between a contractor's license, bond, and insurance, and how each of them protects homeowners.

Each of these credentials is designed to protect the homeowner and helps to ensure that you are working with a dependable, reputable professional capable of doing the work properly.

With the proper bond and insurance, you can rest easy knowing that, should something go wrong with the project, you won't be left financially responsible.

These three credentials are not created equal, and understanding the difference is extremely important when it comes to choosing the right contractor for you and your project.

We'll go over:

Find demolition contractors near you

Contractor's License

Another key factor when it comes to hiring a qualified, professional contractor is to be sure you hire a contractor who is licensed to perform work in that state.

Each state comes with its own licensing requirements, so make sure you understand your state and local licensing laws.

A license acts as a basic indication that your contractor may be qualified to do the work.

Licensing laws are designed to protect property owners from negligent or dishonest contractors. If a contractor isn't licensed, they're likely not pulling required permits or following code regulations, which can end up costing you thousands if you ever tried to resell your home in the future at best, and permanently damage your property at worst.

Depending on your state's licensing laws, it could be relatively simple to acquire a contractor's license. This is why the contractor should also be bonded and insured.

Keep reading:

- Licensed vs Unlicensed: Why It's Important to Hire a Licensed Contractor

- Tips for Clients Dealing with Contractors

- How to Be Sure You Hire the Right Commercial Demolition Contractor

Contractor's Bond

A contractor can purchase a bond from a surety company and is essentially their way of guaranteeing they will provide honest, professional, and ethical services to their customers. Should something go wrong during a project, the customer can file against the bond for financial restitution.

Examples of projects gone wrong include:

- The contractor doesn't finish the project.

- The contractor doesn't pay for the proper permits.

- The contractor fails to meet another financial obligation (i.e. paying subcontractors).

The requirements for obtaining a bond vary from state-to-state, as well as from one municipality to the next, so make sure you do your research before hiring a contractor. To confirm that a contractor is bonded, ask for his/her bond number and certification.

In the event that something goes wrong or you're not satisfied with the project's outcome, you can reach out to the surety company directly.

Learn more: Easily Find a Demolition Contractor With Hometown

Contractor's Insurance

There are two common types of insurance for contractors: liability insurance and workers' compensation.

Liability Insurance

Liability insurance ensures three main things:

- Contractors meet state and industry requirements for performing that work.

- Contractors can afford to pay for damages—as well as lawyers' fees—should they be sued for their work.

- Contractor's customers will not be held responsible should the contractor end up being sued.

In the event that a contractor causes damage to your property, their liability insurance has you covered. If the work is simply poorly done and needs to be fixed, a bond will cover that.

Workers' Compensation

Workers' compensation is designed to cover the cost of medical expenses related to on-the-job injuries, including lost wages, medical services, and legal fees.

If you hire a contractor who does not legally protect themselves or their employees from accidents and injuries, they can sue you if they're injured on your property and you can be held financially responsible for their medical expenses and other damages.

Find a demolition contractor in your area

Keep reading: