Updated February 8, 2024

If a contractor isn't insured and something goes wrong on the job, the property owner is usually the one left footing the bill.

That's why hiring the right demolition contractor who is properly insured is so important.

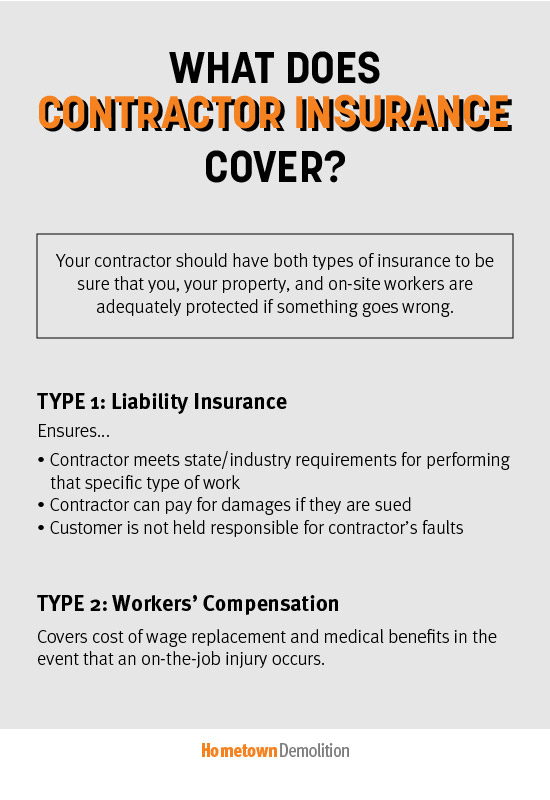

There are two common types of contractor's insurance: liability insurance and workers' compensation. These are not the same, and each type covers different scenarios.

We'll go over both of these types of insurance in detail to explain their importance and how to make sure your demolition contractor is properly insured.

Jump to:

Find licensed and insured demolition contractors in my area

Workers' Compensation

There are inherent risks involved in demolition work, including environmental hazards like lead or asbestos exposure, structural collapses, accidents involving tools or heavy machinery, and more.

Any contractor that hires employees to perform work must carry workers' compensation to protect themselves and their clients from legal action in the event an accident occurs. A freelance contractor who does not employee anyone is not required to carry this type of insurance, as they aren't considered an employee on their own.

If a worker gets injured performing demolition, workers' compensation protects the property owner from being liable to cover the costs associated with the accident, like the cost of wage replacement and medical benefits.

This coverage generally includes medical services, legal fees, lost wages, etc.

Generally, this type of coverage is in exchange for the employee giving up the right to sue their employer. However, if your contractor doesn't have workers' compensation insurance to begin with, the injured worker can sue the "prime contractor", which typically ends up being the owner of the property being worked on.

A property owner being sued for the injuries of a contractor's employee(s) will often have to cover all these costs themselves, as their property insurance may not protect them from any damage caused by hiring an uninsured contractor. This will depend on the property owner's individual insurance policy.

Not only can this put the property owner in financial jeopardy, but the costs can even be indefinite in the case of severe injuries with long-lasting impacts.

For example, if a contractor's employee gets injured on your property and racks up hundreds of thousands of dollars in medical bills and needs medical assistance or therapy for the rest of their life, you could end up having to choose between filing bankruptcy and losing everything you own, or working to pay off their medical bills and loss of wages for the rest of your life.

Any amount of money you might save initially by hiring an unlicensed and insured contractor is never worth the risks involved and long-standing implications it can have.

Learn more:

- Licensed vs Unlicensed: Why It's Important to Hire a Licensed Contractor

- Licensing 101: A State-by-State Guide to Contractor License Requirements

- Who’s Responsible If My Contractor Doesn’t Pull a Permit?

Liability Insurance

Liability insurance ensures three other very important things:

- The contractor meets state and industry requirements for performing that specific work.

- In the event that the contractor is sued for their work, they can pay for any damages (as well as any lawyers' fees).

- It protects the people employing the contractor from being held responsible should the contractor end up getting sued.

You can verify a contractor's insurance by requesting to see their certificate of insurance that is issues by a legitimate insurance company. Be sure to read the fine print and ensure that the names and coverage dates are accurate.

There are many different ways that hiring a contractor without liability insurance can cost you. One example is in the event that your contractor damages your property.

If your property is damaged due to the negligence of an uninsured contractor, you will most likely be responsible for any repairs that are necessary as a result.

Imagine hiring a contractor for $2,000 worth of work, only to end up having to pay $50,000 in damages because the contractor didn't carry the correct insurance.

It can even be illegal to hire an uninsured contractor depending on where you live!

One sign that a contractor might not be insured is if they quote you a super low project quote compared to other contractors in the area. If a contractor is willing to cut legal corners and low-ball your project, you can safely assume that they won't take the time pride in their work or care for your property in the way that a legitimate business owner will.

Getting multiple quotes from demolition contractors in your area will help you get an idea for what a fair going rate is for the type of work you're having done.

Hometown makes it easy to get free quotes from licensed, bonded, and insured local demolition contractors across the U.S.

By filling out our single quote request form, you'll only have to answer questions about your demo project once before sending it out to different contractors in your area for free project estimates. You'll be able to compare pricing, customer service, and availability quickly and efficiently by searching for demolition contractors on Hometown.

Get free quotes from insured demolition contractors near me

Keep reading: